Natural health trends look overvalued based on fundamentals (NASDAQ:NHTC)

Investment thesis

I have always loved high yielding dividend opportunities and my very first SA article was about a gold producer with a dividend yield of over 7%. With this in mind, I am launching a new series of articles focusing on dividend companies double digit returns. Headlines can be bullish or bearish and today you can read my thoughts on natural health trends (NASDAQ: NASDAQ: NHTC). It is a small China-focused direct selling and e-commerce company with a dividend yield of 11.16% at the time of writing.

I think Natural Health Trends can continue to pay out dividends of $0.20 per share every quarter for about five years. However, the fundamentals look bad and I am bearish. Turnover is down, as is the number of active members. Also, the business is barely profitable and I just don’t like the industry.

Company Overview

Natural Health Trends was founded two decades ago and specializes in the sale of health, wellness and nutritional supplement products under the NHT Global brand.

(Source: Trends in Natural Health)

The company offers people the opportunity to earn money through its tiered compensation plan structure. As the Online Wealth Chronicles explains, this is your typical multi-level marketing (MLM) business in an industry dominated by Amway, Avon and Herbalife (NYSE:HLF). I have never been a fan of this economic model. I have an ex-girlfriend who was into Oriflame, a friend of mine in college tried to pitch me one, and even my mom at one point joined an MLM.

The idea is that you usually end up trying to sell overpriced cosmetics to your friends and family and the only way to make decent money is to move up the ranks. As Last Week Tonight explained in their 2016 episode on MLMs, it’s a pro-poor business where most people end up losing money. Since online sales are becoming more and more popular every day, I find it strange that MLMs are still going strong.

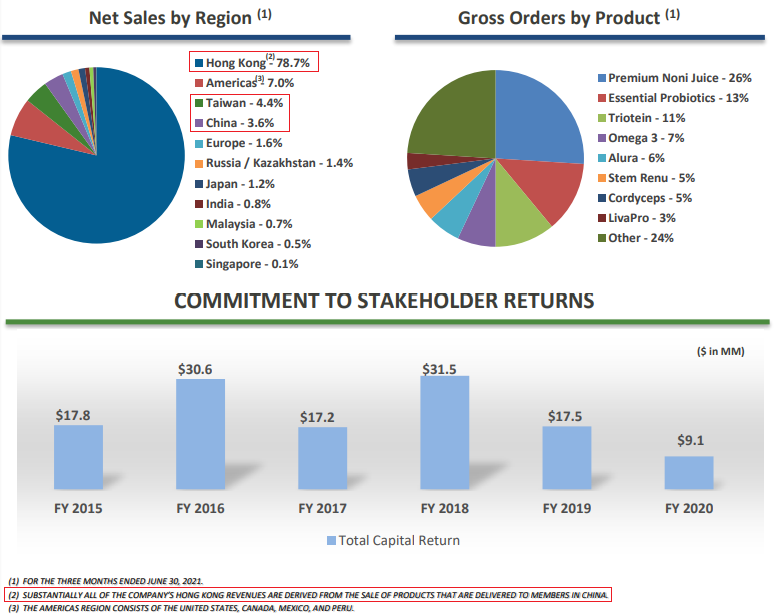

Anyway, back to natural health trends. The company claims in its LinkedIn profile that it is a global network marketing company with products and distributors in over 40 countries around the world. However, looking at the financial statements for the second quarter of 2021, we can see that more than 86% of net sales come from China and Taiwan.

(Source: Trends in Natural Health)

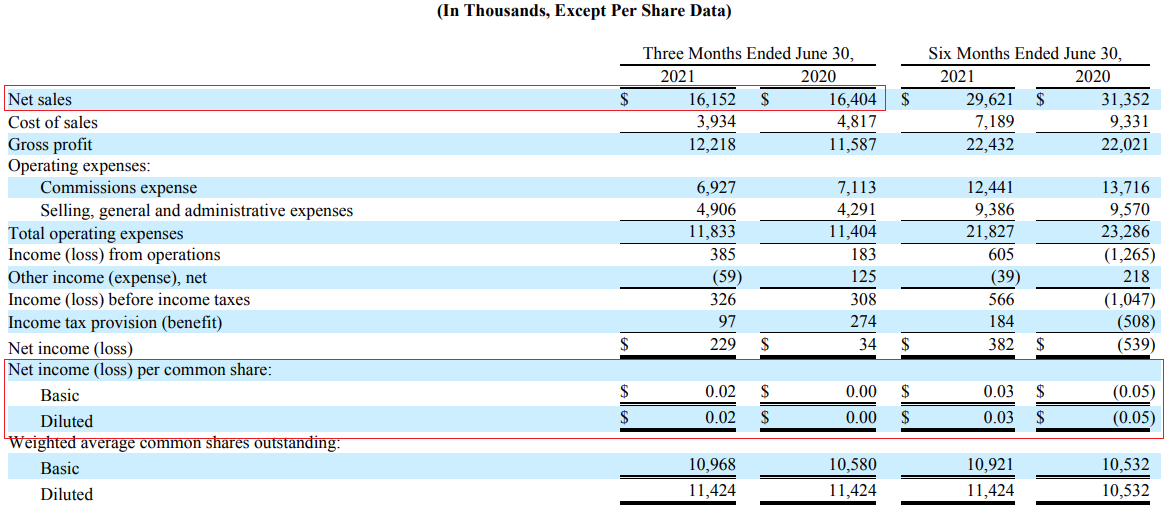

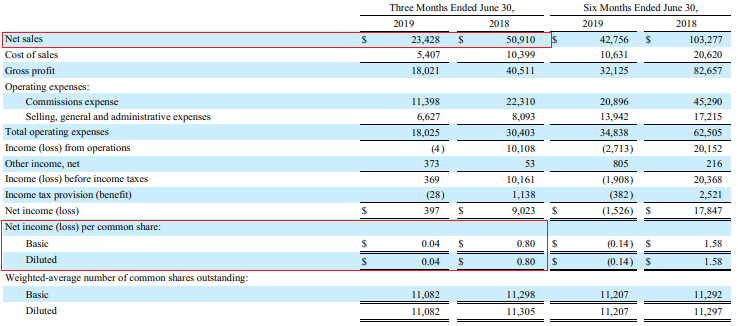

Net sales have been falling for years and amounted to just over $16 million in the second quarter of 2021. The company is barely profitable at the moment and net profit for the first half of 2021 was 0.03 $ per share.

(Source: Trends in Natural Health)

(Source: Trends in Natural Health)

The main reason for the deteriorating finances is the growing number of active members and Natural Health Trends doesn’t seem to have a solution in store. As of June 2018, there were approximately 93,000 active members. By June 2021, their number had fallen to just 46,860.

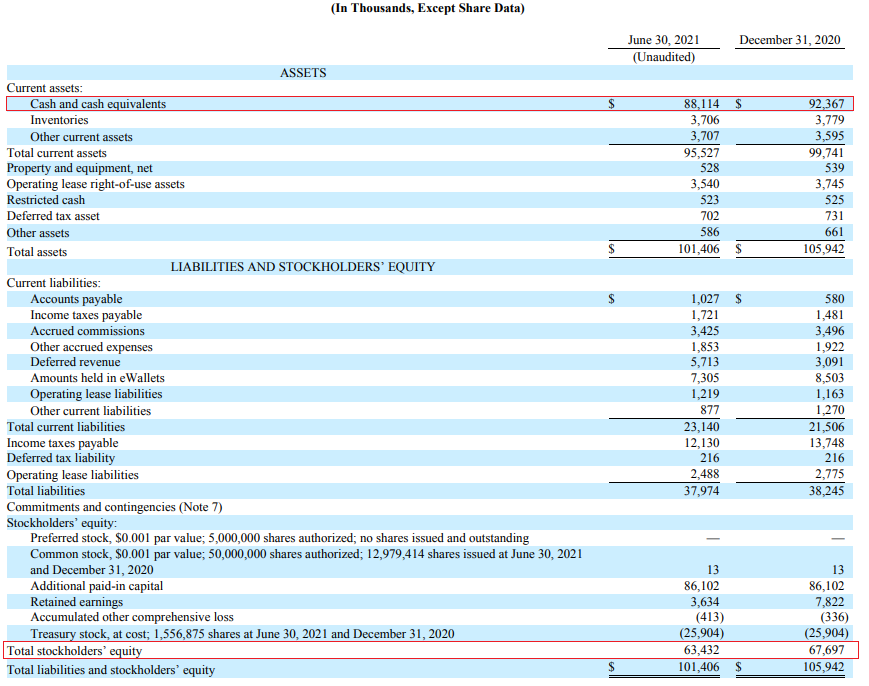

Well, if the company is doing so poorly, how does Natural Health Trends continue to pay quarterly dividends of $0.20 per share every quarter? The answer is ample cash reserves. As of June 2021, the company had $88.1 million in cash and cash equivalents, which represented more than 85% of its asset base. There were no debts and the balance sheet looked very strong in June.

Those $0.20 per share dividends cost $4.57 million each quarter, meaning Natural Health Trends can keep its dividend policy unchanged for nearly five years before running out of cash, even if the company doesn’t. generates no profit.

(Source: Trends in Natural Health)

Overall, I think Natural Health Trends is fundamentally overrated right now. Of course, the dividend yield is quite high, but sales are declining and the company is barely profitable at the moment. I don’t think the latter should be worth much. Natural Health Trends has a market capitalization of $77 million at the time of writing, which is lower than its cash position. However, shareholders’ equity was $63.4 million in June and I don’t see any assets on the balance sheet that could be worth more than their book value. Fixed assets were just over $0.5 million in June.

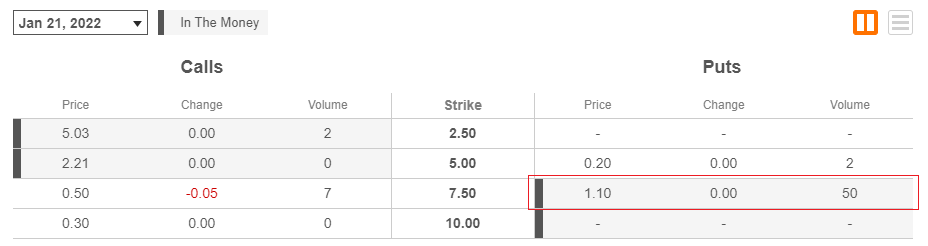

In light of that, I’m bearish on this one, and investors can take advantage of that by shorting the stock or buying put options. According to data from Fintel, the short-term borrowing fee rate stands at just 2.24% at the time of writing.

In case you prefer to protect yourself from the downside, I think put options are a good idea. They don’t seem too expensive at the moment, but keep in mind that the volume is quite low.

(Source: Search Alpha)

(Source: Search Alpha)

Takeaway for investors

I plan to bring you long and short opportunities in the double digit dividend yield market in the future and as I write mostly bearish articles in 2021 I thought it would be appropriate to start this new series with a short- selling idea.

I view Natural Health Trends as a slowly dying MLM company that simply refuses to give up on its generous dividend policy. The company can go on like this for several years, but I don’t think market capitalization should be greater than equity. The company’s net sales have been declining for years and the business is barely profitable. In my opinion, the latter should not be worth much.

The only major risk to the bearish case that I can think of is a successful product launch in the next few quarters that manages to boost sales. For example, Natural Health Trends launched its Ultra B Complex supplement in North America in May and in Hong Kong in June.